Warrants are stock options issued on the issuer’s own stock. They are often issued as “sweeteners” or “kickers” when issuers sell equity in private placements. Warrants are rarely registered for public trading, so their liquidity is limited.

Warrant Discounts

Since warrants are not typically registered for public trading, they are less liquid than securities that trade publicly. Since warrants usually have no counterparts trading in public markets, holders cannot take advantage of Rule 144 to resell their warrants.

The only way for most warrant holders to obtain liquidity is to exercise the warrant and sell the stock. Because of this, most warrants sell at a higher discount than restricted stock. The stock can be sold only if it has been registered or if its holder complies with Rule 144, including its six-month holding period. However, when holders have the ability to exercise on a cashless basis, they can usually tack the holding period of the warrant onto the holding period for the stock for the purpose of complying with Rule 144. As a result, cashless warrant positions, all else being equal, may sell at lower discounts.

Black-Scholes-Merton Formula

While warrants can be valued using many different methods, the most common is the Black-Scholes-Merton model, which provides warrant or option values based on six inputs:

- Stock price

- Exercise price

- Volatility

- Time to expiration

- Risk-free rate of return

- Dividend yield

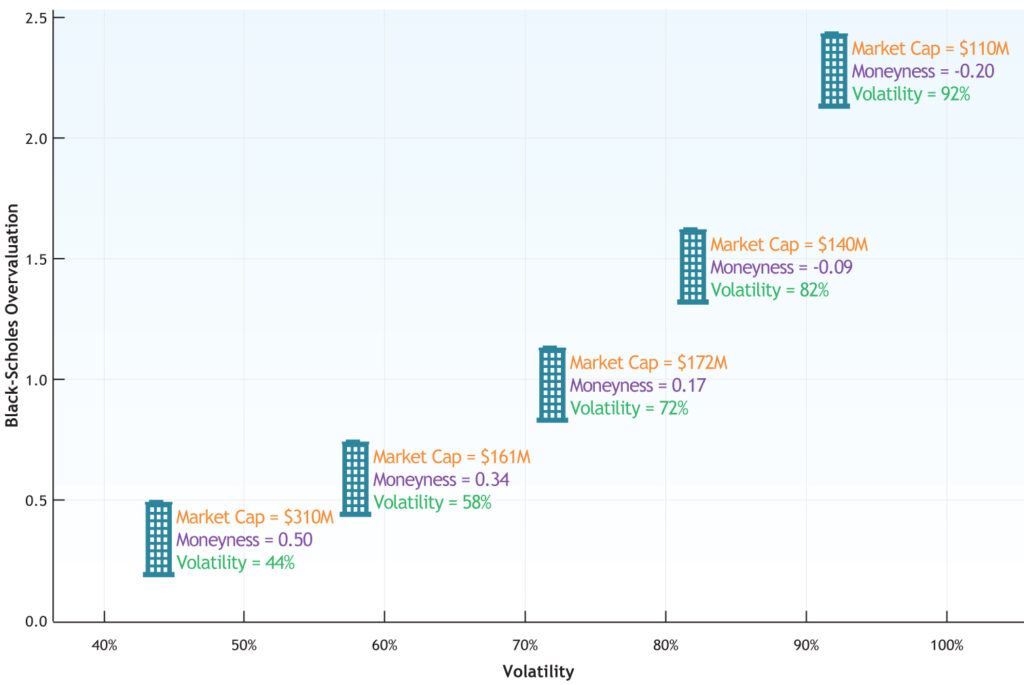

This formula is based on many assumptions, one of the most important of which is that both the warrant and the underlying stock are fully liquid. As a result, the formula provides incorrect values for illiquid securities. Empirical data is needed to bridge the gap between the theoretical models and market realities.

Empirical Studies

The LiquiStat™ database is the only current study we know of that includes market transactions in illiquid warrants. As with restricted stock, LiquiStat™ sheds light on the many different factors that drive the value of illiquid warrants. All available trading data shows that illiquid warrants trade at a substantial illiquidity “haircut” – in other words, the Black-Scholes formula (and any other theoretical methods, such as lattice models) overvalues warrants by significant amounts.

Valuing Warrants

Because of the shortcomings of theoretical models, analysts who value illiquid warrants must consider not only the six factors of the Black-Scholes-Merton model, but also the following:

- Prices paid for similar blocks in recent sales

- Size of the block held, compared with the trading volume for the stock

- Financial characteristics of the issuer, including size, balance-sheet risk, profitability, growth and dividend-payout ratio

- Volatility of the stock

- Ability of the holder to sell the stock short during the expected holding period

- Ability of the holder to hedge against stock-price volatility during the holding period

For more information on our warrant valuations, contact Pluris today.