FAS 166, Accounting for Transfers of Financial Assets — an amendment of FASB Statement No. 140 (“FAS 166”), changes the accounting and reporting for transfers and servicing of financial assets and the extinguishment of liabilities. The lion’s share of transactions affected by the new rule is the sale of loans.

The rule primarily affects financial institutions involved in the securitization of financial assets. FAS 166 is effective 1/1/10 formost companies. It cannot be applied retroactively, only prospectively to transfers on or after the effective date of the rule.

This Alert focuses only on aspects of the new rule that impact fair value accounting, including the initial recognition and measurement at fair value of all assets obtained, now including beneficial interests, and liabilities incurred upon the completion of a transfer of an entire financial asset or a group of financial assets accounted for as a sale.

DETERMINING GAIN OR LOSS

When a transfer is accounted for as a sale, the transferor (“seller”) generally books a gain or loss. Sometimes the seller obtains a“beneficial” interest in the sold assets.

Under the old rules, beneficial interests represented an interest retained in the transferred financial asset. In determining gain or loss, the amounts assigned to the portion sold and the beneficial interest retained were determined by allocating the total asset’s carrying amount (both the sold portion and the retained portion) based on relative fair values. After the sale, the total asset is only reduced by the portion sold, and the portion retained remains on the books at allocated carrying value.

Under the new rules, all beneficial interests except participating ones represent sales proceeds. The entire carrying amount of the transferred asset is included for purposes of figuring out gain or loss, not just the allocated carrying amount of loans sold. After the sale, the total asset is reduced to zero, and the portion obtained is recorded on the books, not based on allocated carrying amount, but at fair value.

This means that a transferor must now recognize and initially measure at fair value a transferor’s beneficial interest obtained in a transfer of an entire financial asset or a group of financial assets accounted for as a sale. (The guidance for calculating the gain or loss on a sale of a portion of a financial asset has not changed).

EXAMPLE

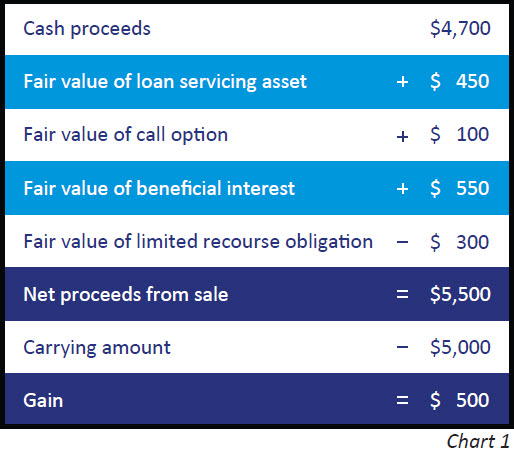

XYZ Company sells a group of individual loans in their entirety with a fair value of $5,500 and a carrying amount of $5,000 in a transfer that qualifies for sale accounting. XYZ will service the loans and has a call option to purchase loans at fair value from the buyer that are similar to the ones sold. XYZ Company assumes a limited recourse obligation to repurchase delinquent loans. XYZ receives a beneficial interest in the transferred assets.

As is illustrated below (Chart 1), under the new rule, the gain on the sale equals net proceeds of $5,500 less the carrying amount of $5,000, or $500.

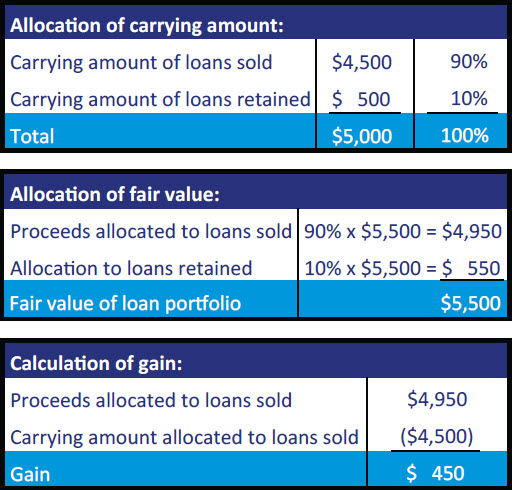

Under the old rules, beneficial interests were not included in net proceeds. Instead, the fair value of the loan of $5,500 was allocated between the loans sold and the loans retained, and the gain was determined from these allocated amounts. Using the same example under the old rule, 90% of the loans were sold and 10% were retained, so 90% of the carrying amount of $5,000 was assigned to the proceeds received for the interest sold, and 10% of the carrying amount of $5,000 was assigned to the beneficial interests that continued to be held by the seller. In calculating the gain, the carrying amount of the loans sold of $4,500 was subtracted from the allocated fair value of the interest sold of $4,950 (4,950 – 4,500 = 450 gain):

You will observe that as long as fair value exceeds carrying value, there will always be a bigger gain under the new rule. If you are affected by this amendment, please contact us to discuss how we might fair value your eligible retained beneficial interests.