On July 7, the SEC sponsored an IFRS roundtable to discuss the impact of adopting IFRS in the U.S. The FASB and the IASB are committed to substantial convergence by the end of the year. The FASB’s issuance of ASU 2011-04, Fair Value Measurement: Amendments to Achieve Common Fair Value Measurement and Disclosure Requirements in U.S. GAAP and IFRS represents final convergence in the area of fair value measurements. This is the first of two alerts designed to provide an overview of the new rules. Read on to review the major provisions of the FASB’s new guidance, how it will impact fair value accounting, and how it compares to IFRS 13.

Highest and best use and valuation premise

The “highest and best use” of an asset is the one that is physically possible, legally permissible, and financially feasible. The new rule specifies that this concept only applies to nonfinancial assets. Highest and best use requires consideration of a market participant’s ability to generate economic benefits by either utilizing the asset or selling the asset to another market participant.

The ASU deletes from ASC 820 (FAS 157) the terms “in-exchange” and “in-use” to describe valuation premise. The guidance provides that the highest and best use is either on a stand-alone basis or in combination with other assets as a group or with other assets and liabilities.

Product specific guidance

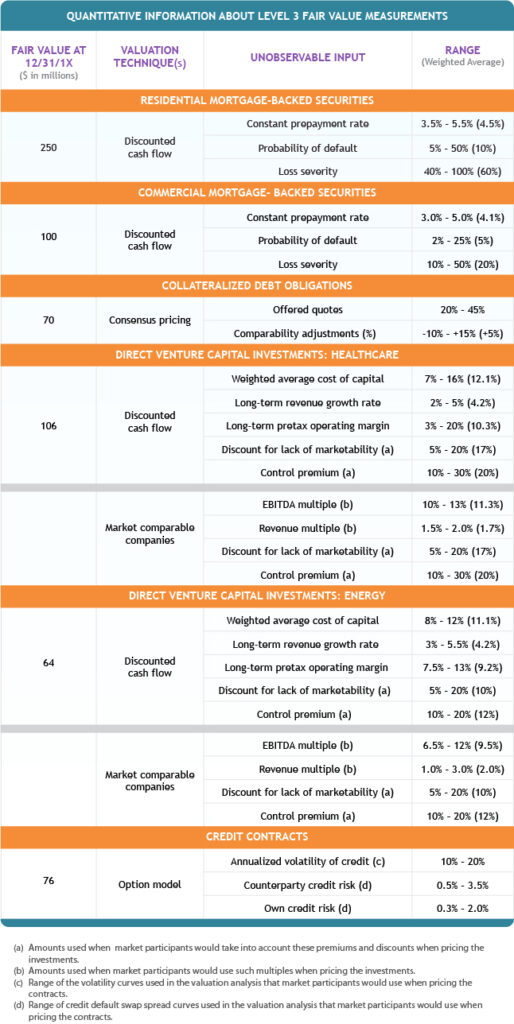

The table below illustrates the requirement to disclose information about quantitative inputs and assumptions for Level 3 measurements. In the ASU’s Basis for Conclusions, the FASB indicated in paragraph B86 that the purpose of this disclosure is to provide information to assess whether a reporting entity’s views about particular inputs differ from their own and, if they do, how to factor in the reporting entity’s fair value measurement in decision making.

Comparison with IFRS 13

The two rules are almost the same in terms of measurements and disclosures. The following differences will remain:

- Because the accounting rules for offsetting are very different between U.S. GAAP and IFRS, amounts disclosed for Level 3 will be different. The Boards are still working on converging offsetting rules.

- QMUA is required under IFRS for Level 3 fair value measurements; it isn’t required under U.S. GAAP for any level.

- Private companies are scoped out of certain disclosures under U.S. GAAP. IFRS has no provision to scope out private companies.

- IFRS does not have special investment company accounting guidance. As such, the practical expedient in U.S. GAAP that permit s an investment company to use net asset value per share for certain measurements is not available under IFRS.

- U.S. GAAP does not prohibit certain day-one gains and losses when the initial fair value of an asset or liability is different from the transaction price. IFRS generally does not allow gains and losses related to unobservable market date.

- U.S. GAAP (ASC 825 and 942) provides that the fair value of a deposit liability is the amount payable on demand as of the reporting date. Under IFRS 13, the amount can’t be less than the present value of the amount payable on demand.

- Other minor differences related to language style and technical references.

Effective Date and Transition

The new rule is effective for public companies for interim and annual reporting periods beginning after December 15, 2011 (the first quarter of 2012 for calendar-year companies), and for nonpublic companies for annual periods beginning after December 15, 2011. Nonpublic companies may early adopt the amendments for interim periods beginning after December 15, 2011.

The ASU should be applied prospectively. As such, there will be no cumulative adjustment to opening retained earnings. If the implementation of the new rule results in a change in valuation technique and related inputs, the financial effects of such change should be quantified and disclosed, if practicable.

Nonpublic companies are not required to make the following disclosures:

- Transfers between Level 1 and 2

- Generally, the information required of public companies when fair value is disclosed but not reported in the financial statements

- Qualitative discussion of sensitivity of fair value to changes in unobservable inputs and interrelationships between those inputs

Conclusion

Most of the globe is now reporting under IFRS or has a timeline to adopt. Two countries remain in the global conversion to a uniform set of accounting standards: the U.S. and Japan. In the U.S., the SEC has indicated it will make an announcement in 2011. In May, the SEC released a staff paper describing an approach to adopting IFRS and is soliciting comments. In Japan, the Minister of Finance announced implementation delays last month. Japan will likely adopt a timeline similar to that in the U.S. Now that fair value accounting is substantially converged, companies should review their valuation methods and accounting policies and procedures related to fair value accounting. Please contact Pluris to discuss how the new guidance will impact your company, and to assess the impact of IFRS.