By : Paul R. La Monica | February, 2 2012

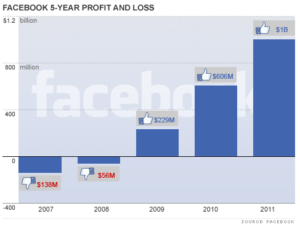

NEW YORK (CNNMoney) -- Facebook is a great company. It proved that in its IPO filing. A billion dollar annual profit and $3.9 billion in cash for something that didn't even exist 10 years ago? That's impressive.

But it's not impressive enough to justify a $100 billion market value right out of the gate.

paul_lamonica_morning_buzz2.jpg

Sure, we don't yet know what Facebook will be worth once it starts trading in a few months.

The company said Wednesday that it had determined that the fair value of a Facebook share stands at $29.73, as of December 31. That would value founder and CEO Mark Zuckerberg's stake at about $16 billion.

Based on Facebook's current share count, you could come up with a rough estimate of about $60 billion for the company's market value.

But it seems highly likely that Facebook will price its offering above its most recent fair value estimate. As such, some experts have thrown out the $100 billion number as a possible market value.

I fail to see how that makes sense. Yes, Facebook is growing rapidly. It deserves a premium compared to companies like Microsoft (MSFT, Fortune 500) and Google (GOOG, Fortune 500), which are the only two publicly traded firms that Facebook listed as "significant competition."

But let's do the math. Microsoft is trading at only 11 times its net income for fiscal 2011. Google is valued at about 20 times its 2011 profits. If Facebook were to fetch a $100 billion market value, that would give it a price-to-earnings ratio of 100.

Meet the man behind the Facebook IPO

The $100 billion number is even crazier when you look at revenue. Google trades for just 5 times trailing sales. Apple (AAPL, Fortune 500) trades at only 4 times last year's sales.

Sure, Apple may not be a direct rival to Facebook. But I'd argue that it's fair to look at Apple's valuations as a benchmark since Apple is the best example of a large company that is continuing to grow as if it were just a start-up.

At $100 billion, Facebook would trade at 27 times last year's sales. That might have worked in 1999. Not now.

Yes, I realize that investors are betting on the next few years, not the past few.

"There is no way you can justify the current valuation with $3.7 billion in revenue," said Espen Robak, president of Pluris Valuation Advisors in New York. "But the promise of the company is enormous. You are buying the future."

Still, let's assume that Facebook's profits increase 65% in 2012, like they did in 2011. That's probably optimistic, since Facebook conceded in its filing that it expects growth to slow for both new users and revenue. But for the sake of argument, let's forecast net income of $1.65 billion for 2012.

A $100 billion market value would imply a P/E of about 60 on 2012 earnings forecasts. That's still pretty lofty -- especially if growth is already starting to slow.

"Think about Google. Right now it's trading at around 20 times earnings. That's a modest multiple and that's ultimately where Facebook may deserve to be," Robak said.

A P/E of 20 times my back of the envelope 2012 earnings forecast gives you a market value of $33 billion. But even if we give Facebook a fat premium of say, 40 times earnings, you still only get to a value of $66 billion.

That seems a little more reasonable. Facebook needs to play catch-up with its valuation. If it eventually is going to command a more sizeable premium than Google, it will need to prove to Wall Street that it can grow at a healthy clip for several more years.

That won't be easy.

Don't get me wrong: What Facebook has achieved in a few years is spectacular. It deserves some sort of premium. Facebook's operating margins last year were 47%. That's phenomenal. Google, by way of comparison, had operating margins of 31%.

"We can recognize that Facebook has built a successful global brand with great scale," said Lorraine Monick, managing director with Harris myCFO Investment Advisory Services, a money manager in Palo Alto, Calif.

That's true. But scale isn't enough to justify a bubble-like valuation. Yahoo (YHOO, Fortune 500) always enjoyed the benefits of great scale. It still does.

Facebook IPO: Morgan Stanley is the big winner

While Facebook is clearly in much much much better shape than Yahoo, it's not far-fetched to think that in a few years, Facebook may face some similar problems.

Facebook already has 845 million users. There isn't that much more room to grow that number. The challenge will be squeezing more profits from these users.

"If Facebook can make more money from their existing platform, they are golden," said Tim Loughran, a finance professor at University of Notre Dame. "But Facebook is much more mature than Google was in 2004. Where's the user growth going to come from?"

China is a logical answer -- but that's fraught territory.

"We do not know if we will be able to find an approach to managing content and information that will be acceptable to us and to the Chinese government," Facebook said in its filing.

Of course, none of my skepticism will make a difference when Facebook starts trading. The demand for the Facebook IPO will probably be so hot that investors will buy first and ask questions later. The $5 billion worth of stock Facebook plans to sell is a tiny amount.

"Given the small float and scarcity factor, everybody will want a piece of the action," Loughran said.

But mark my words: Valuations still matter. Eventually, Facebook will have to trade at a price that's more in line with its peers.

Best of StockTwits. Not enough on Facebook? I didn't think so.

A_F: $FB is the new $YHOO in that it has 'reach' - but $GOOG ads still monetize better for advertisers imo

JoshPritchard: $FB core product captures users' time, $GOOG core captures intent; former better for demand generation, latter demand fulfillment

Agreed. I continue to think Google's model makes mores sense because their ads should have more value.

divtastic: If there's any one stock to trade $FB it's $ZNGA

Correct. And Zynga (ZNGA), which accounted for about 12% of Facebook's sales, is up sharply Thursday. I've been surprised by how poorly Zynga has done since its IPO given how closely aligned with Facebook it is.

margbrennan: Bono's venture capital firm Elevation Partners paid $120M for a stake in facebook in '10. It is now worth ~$1.5B. $FB #beautifulday

But will Facebook shares move in mysterious ways?

The opinions expressed in this commentary are solely those of Paul R. La Monica. Other than Time Warner, the parent of CNNMoney, and Abbott Laboratories, La Monica does not own positions in any individual stocks. To top of page

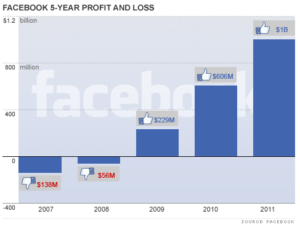

NEW YORK (CNNMoney) -- Facebook is a great company. It proved that in its IPO filing. A billion dollar annual profit and $3.9 billion in cash for something that didn't even exist 10 years ago? That's impressive.

But it's not impressive enough to justify a $100 billion market value right out of the gate.

paul_lamonica_morning_buzz2.jpg

Sure, we don't yet know what Facebook will be worth once it starts trading in a few months.

The company said Wednesday that it had determined that the fair value of a Facebook share stands at $29.73, as of December 31. That would value founder and CEO Mark Zuckerberg's stake at about $16 billion.

Based on Facebook's current share count, you could come up with a rough estimate of about $60 billion for the company's market value.

But it seems highly likely that Facebook will price its offering above its most recent fair value estimate. As such, some experts have thrown out the $100 billion number as a possible market value.

I fail to see how that makes sense. Yes, Facebook is growing rapidly. It deserves a premium compared to companies like Microsoft (MSFT, Fortune 500) and Google (GOOG, Fortune 500), which are the only two publicly traded firms that Facebook listed as "significant competition."

But let's do the math. Microsoft is trading at only 11 times its net income for fiscal 2011. Google is valued at about 20 times its 2011 profits. If Facebook were to fetch a $100 billion market value, that would give it a price-to-earnings ratio of 100.

Meet the man behind the Facebook IPO

The $100 billion number is even crazier when you look at revenue. Google trades for just 5 times trailing sales. Apple (AAPL, Fortune 500) trades at only 4 times last year's sales.

Sure, Apple may not be a direct rival to Facebook. But I'd argue that it's fair to look at Apple's valuations as a benchmark since Apple is the best example of a large company that is continuing to grow as if it were just a start-up.

At $100 billion, Facebook would trade at 27 times last year's sales. That might have worked in 1999. Not now.

Yes, I realize that investors are betting on the next few years, not the past few.

"There is no way you can justify the current valuation with $3.7 billion in revenue," said Espen Robak, president of Pluris Valuation Advisors in New York. "But the promise of the company is enormous. You are buying the future."

Still, let's assume that Facebook's profits increase 65% in 2012, like they did in 2011. That's probably optimistic, since Facebook conceded in its filing that it expects growth to slow for both new users and revenue. But for the sake of argument, let's forecast net income of $1.65 billion for 2012.

A $100 billion market value would imply a P/E of about 60 on 2012 earnings forecasts. That's still pretty lofty -- especially if growth is already starting to slow.

"Think about Google. Right now it's trading at around 20 times earnings. That's a modest multiple and that's ultimately where Facebook may deserve to be," Robak said.

A P/E of 20 times my back of the envelope 2012 earnings forecast gives you a market value of $33 billion. But even if we give Facebook a fat premium of say, 40 times earnings, you still only get to a value of $66 billion.

That seems a little more reasonable. Facebook needs to play catch-up with its valuation. If it eventually is going to command a more sizeable premium than Google, it will need to prove to Wall Street that it can grow at a healthy clip for several more years.

That won't be easy.

Don't get me wrong: What Facebook has achieved in a few years is spectacular. It deserves some sort of premium. Facebook's operating margins last year were 47%. That's phenomenal. Google, by way of comparison, had operating margins of 31%.

"We can recognize that Facebook has built a successful global brand with great scale," said Lorraine Monick, managing director with Harris myCFO Investment Advisory Services, a money manager in Palo Alto, Calif.

That's true. But scale isn't enough to justify a bubble-like valuation. Yahoo (YHOO, Fortune 500) always enjoyed the benefits of great scale. It still does.

Facebook IPO: Morgan Stanley is the big winner

While Facebook is clearly in much much much better shape than Yahoo, it's not far-fetched to think that in a few years, Facebook may face some similar problems.

Facebook already has 845 million users. There isn't that much more room to grow that number. The challenge will be squeezing more profits from these users.

"If Facebook can make more money from their existing platform, they are golden," said Tim Loughran, a finance professor at University of Notre Dame. "But Facebook is much more mature than Google was in 2004. Where's the user growth going to come from?"

China is a logical answer -- but that's fraught territory.

"We do not know if we will be able to find an approach to managing content and information that will be acceptable to us and to the Chinese government," Facebook said in its filing.

Of course, none of my skepticism will make a difference when Facebook starts trading. The demand for the Facebook IPO will probably be so hot that investors will buy first and ask questions later. The $5 billion worth of stock Facebook plans to sell is a tiny amount.

"Given the small float and scarcity factor, everybody will want a piece of the action," Loughran said.

But mark my words: Valuations still matter. Eventually, Facebook will have to trade at a price that's more in line with its peers.

Best of StockTwits. Not enough on Facebook? I didn't think so.

A_F: $FB is the new $YHOO in that it has 'reach' - but $GOOG ads still monetize better for advertisers imo

JoshPritchard: $FB core product captures users' time, $GOOG core captures intent; former better for demand generation, latter demand fulfillment

Agreed. I continue to think Google's model makes mores sense because their ads should have more value.

divtastic: If there's any one stock to trade $FB it's $ZNGA

Correct. And Zynga (ZNGA), which accounted for about 12% of Facebook's sales, is up sharply Thursday. I've been surprised by how poorly Zynga has done since its IPO given how closely aligned with Facebook it is.

margbrennan: Bono's venture capital firm Elevation Partners paid $120M for a stake in facebook in '10. It is now worth ~$1.5B. $FB #beautifulday

But will Facebook shares move in mysterious ways?

The opinions expressed in this commentary are solely those of Paul R. La Monica. Other than Time Warner, the parent of CNNMoney, and Abbott Laboratories, La Monica does not own positions in any individual stocks. To top of page

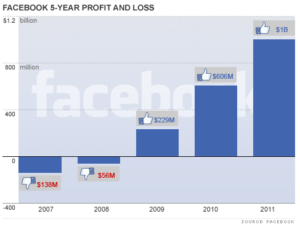

NEW YORK (CNNMoney) -- Facebook is a great company. It proved that in its IPO filing. A billion dollar annual profit and $3.9 billion in cash for something that didn't even exist 10 years ago? That's impressive.

But it's not impressive enough to justify a $100 billion market value right out of the gate.

paul_lamonica_morning_buzz2.jpg

Sure, we don't yet know what Facebook will be worth once it starts trading in a few months.

The company said Wednesday that it had determined that the fair value of a Facebook share stands at $29.73, as of December 31. That would value founder and CEO Mark Zuckerberg's stake at about $16 billion.

Based on Facebook's current share count, you could come up with a rough estimate of about $60 billion for the company's market value.

But it seems highly likely that Facebook will price its offering above its most recent fair value estimate. As such, some experts have thrown out the $100 billion number as a possible market value.

I fail to see how that makes sense. Yes, Facebook is growing rapidly. It deserves a premium compared to companies like Microsoft (MSFT, Fortune 500) and Google (GOOG, Fortune 500), which are the only two publicly traded firms that Facebook listed as "significant competition."

But let's do the math. Microsoft is trading at only 11 times its net income for fiscal 2011. Google is valued at about 20 times its 2011 profits. If Facebook were to fetch a $100 billion market value, that would give it a price-to-earnings ratio of 100.

Meet the man behind the Facebook IPO

The $100 billion number is even crazier when you look at revenue. Google trades for just 5 times trailing sales. Apple (AAPL, Fortune 500) trades at only 4 times last year's sales.

Sure, Apple may not be a direct rival to Facebook. But I'd argue that it's fair to look at Apple's valuations as a benchmark since Apple is the best example of a large company that is continuing to grow as if it were just a start-up.

At $100 billion, Facebook would trade at 27 times last year's sales. That might have worked in 1999. Not now.

Yes, I realize that investors are betting on the next few years, not the past few.

"There is no way you can justify the current valuation with $3.7 billion in revenue," said Espen Robak, president of Pluris Valuation Advisors in New York. "But the promise of the company is enormous. You are buying the future."

Still, let's assume that Facebook's profits increase 65% in 2012, like they did in 2011. That's probably optimistic, since Facebook conceded in its filing that it expects growth to slow for both new users and revenue. But for the sake of argument, let's forecast net income of $1.65 billion for 2012.

A $100 billion market value would imply a P/E of about 60 on 2012 earnings forecasts. That's still pretty lofty -- especially if growth is already starting to slow.

"Think about Google. Right now it's trading at around 20 times earnings. That's a modest multiple and that's ultimately where Facebook may deserve to be," Robak said.

A P/E of 20 times my back of the envelope 2012 earnings forecast gives you a market value of $33 billion. But even if we give Facebook a fat premium of say, 40 times earnings, you still only get to a value of $66 billion.

That seems a little more reasonable. Facebook needs to play catch-up with its valuation. If it eventually is going to command a more sizeable premium than Google, it will need to prove to Wall Street that it can grow at a healthy clip for several more years.

That won't be easy.

Don't get me wrong: What Facebook has achieved in a few years is spectacular. It deserves some sort of premium. Facebook's operating margins last year were 47%. That's phenomenal. Google, by way of comparison, had operating margins of 31%.

"We can recognize that Facebook has built a successful global brand with great scale," said Lorraine Monick, managing director with Harris myCFO Investment Advisory Services, a money manager in Palo Alto, Calif.

That's true. But scale isn't enough to justify a bubble-like valuation. Yahoo (YHOO, Fortune 500) always enjoyed the benefits of great scale. It still does.

Facebook IPO: Morgan Stanley is the big winner

While Facebook is clearly in much much much better shape than Yahoo, it's not far-fetched to think that in a few years, Facebook may face some similar problems.

Facebook already has 845 million users. There isn't that much more room to grow that number. The challenge will be squeezing more profits from these users.

"If Facebook can make more money from their existing platform, they are golden," said Tim Loughran, a finance professor at University of Notre Dame. "But Facebook is much more mature than Google was in 2004. Where's the user growth going to come from?"

China is a logical answer -- but that's fraught territory.

"We do not know if we will be able to find an approach to managing content and information that will be acceptable to us and to the Chinese government," Facebook said in its filing.

Of course, none of my skepticism will make a difference when Facebook starts trading. The demand for the Facebook IPO will probably be so hot that investors will buy first and ask questions later. The $5 billion worth of stock Facebook plans to sell is a tiny amount.

"Given the small float and scarcity factor, everybody will want a piece of the action," Loughran said.

But mark my words: Valuations still matter. Eventually, Facebook will have to trade at a price that's more in line with its peers.

Best of StockTwits. Not enough on Facebook? I didn't think so.

A_F: $FB is the new $YHOO in that it has 'reach' - but $GOOG ads still monetize better for advertisers imo

JoshPritchard: $FB core product captures users' time, $GOOG core captures intent; former better for demand generation, latter demand fulfillment

Agreed. I continue to think Google's model makes mores sense because their ads should have more value.

divtastic: If there's any one stock to trade $FB it's $ZNGA

Correct. And Zynga (ZNGA), which accounted for about 12% of Facebook's sales, is up sharply Thursday. I've been surprised by how poorly Zynga has done since its IPO given how closely aligned with Facebook it is.

margbrennan: Bono's venture capital firm Elevation Partners paid $120M for a stake in facebook in '10. It is now worth ~$1.5B. $FB #beautifulday

But will Facebook shares move in mysterious ways?

The opinions expressed in this commentary are solely those of Paul R. La Monica. Other than Time Warner, the parent of CNNMoney, and Abbott Laboratories, La Monica does not own positions in any individual stocks. To top of page NEW YORK (CNNMoney) -- Facebook is a great company. It proved that in its IPO filing. A billion dollar annual profit and $3.9 billion in cash for something that didn't even exist 10 years ago? That's impressive.

But it's not impressive enough to justify a $100 billion market value right out of the gate.

paul_lamonica_morning_buzz2.jpg

Sure, we don't yet know what Facebook will be worth once it starts trading in a few months.

The company said Wednesday that it had determined that the fair value of a Facebook share stands at $29.73, as of December 31. That would value founder and CEO Mark Zuckerberg's stake at about $16 billion.

Based on Facebook's current share count, you could come up with a rough estimate of about $60 billion for the company's market value.

But it seems highly likely that Facebook will price its offering above its most recent fair value estimate. As such, some experts have thrown out the $100 billion number as a possible market value.

I fail to see how that makes sense. Yes, Facebook is growing rapidly. It deserves a premium compared to companies like Microsoft (MSFT, Fortune 500) and Google (GOOG, Fortune 500), which are the only two publicly traded firms that Facebook listed as "significant competition."

But let's do the math. Microsoft is trading at only 11 times its net income for fiscal 2011. Google is valued at about 20 times its 2011 profits. If Facebook were to fetch a $100 billion market value, that would give it a price-to-earnings ratio of 100.

Meet the man behind the Facebook IPO

The $100 billion number is even crazier when you look at revenue. Google trades for just 5 times trailing sales. Apple (AAPL, Fortune 500) trades at only 4 times last year's sales.

Sure, Apple may not be a direct rival to Facebook. But I'd argue that it's fair to look at Apple's valuations as a benchmark since Apple is the best example of a large company that is continuing to grow as if it were just a start-up.

At $100 billion, Facebook would trade at 27 times last year's sales. That might have worked in 1999. Not now.

Yes, I realize that investors are betting on the next few years, not the past few.

"There is no way you can justify the current valuation with $3.7 billion in revenue," said Espen Robak, president of Pluris Valuation Advisors in New York. "But the promise of the company is enormous. You are buying the future."

Still, let's assume that Facebook's profits increase 65% in 2012, like they did in 2011. That's probably optimistic, since Facebook conceded in its filing that it expects growth to slow for both new users and revenue. But for the sake of argument, let's forecast net income of $1.65 billion for 2012.

A $100 billion market value would imply a P/E of about 60 on 2012 earnings forecasts. That's still pretty lofty -- especially if growth is already starting to slow.

"Think about Google. Right now it's trading at around 20 times earnings. That's a modest multiple and that's ultimately where Facebook may deserve to be," Robak said.

A P/E of 20 times my back of the envelope 2012 earnings forecast gives you a market value of $33 billion. But even if we give Facebook a fat premium of say, 40 times earnings, you still only get to a value of $66 billion.

That seems a little more reasonable. Facebook needs to play catch-up with its valuation. If it eventually is going to command a more sizeable premium than Google, it will need to prove to Wall Street that it can grow at a healthy clip for several more years.

That won't be easy.

Don't get me wrong: What Facebook has achieved in a few years is spectacular. It deserves some sort of premium. Facebook's operating margins last year were 47%. That's phenomenal. Google, by way of comparison, had operating margins of 31%.

"We can recognize that Facebook has built a successful global brand with great scale," said Lorraine Monick, managing director with Harris myCFO Investment Advisory Services, a money manager in Palo Alto, Calif.

That's true. But scale isn't enough to justify a bubble-like valuation. Yahoo (YHOO, Fortune 500) always enjoyed the benefits of great scale. It still does.

Facebook IPO: Morgan Stanley is the big winner

While Facebook is clearly in much much much better shape than Yahoo, it's not far-fetched to think that in a few years, Facebook may face some similar problems.

Facebook already has 845 million users. There isn't that much more room to grow that number. The challenge will be squeezing more profits from these users.

"If Facebook can make more money from their existing platform, they are golden," said Tim Loughran, a finance professor at University of Notre Dame. "But Facebook is much more mature than Google was in 2004. Where's the user growth going to come from?"

China is a logical answer -- but that's fraught territory.

"We do not know if we will be able to find an approach to managing content and information that will be acceptable to us and to the Chinese government," Facebook said in its filing.

Of course, none of my skepticism will make a difference when Facebook starts trading. The demand for the Facebook IPO will probably be so hot that investors will buy first and ask questions later. The $5 billion worth of stock Facebook plans to sell is a tiny amount.

"Given the small float and scarcity factor, everybody will want a piece of the action," Loughran said.

But mark my words: Valuations still matter. Eventually, Facebook will have to trade at a price that's more in line with its peers.

Best of StockTwits. Not enough on Facebook? I didn't think so.

A_F: $FB is the new $YHOO in that it has 'reach' - but $GOOG ads still monetize better for advertisers imo

JoshPritchard: $FB core product captures users' time, $GOOG core captures intent; former better for demand generation, latter demand fulfillment

Agreed. I continue to think Google's model makes mores sense because their ads should have more value.

divtastic: If there's any one stock to trade $FB it's $ZNGA

Correct. And Zynga (ZNGA), which accounted for about 12% of Facebook's sales, is up sharply Thursday. I've been surprised by how poorly Zynga has done since its IPO given how closely aligned with Facebook it is.

margbrennan: Bono's venture capital firm Elevation Partners paid $120M for a stake in facebook in '10. It is now worth ~$1.5B. $FB #beautifulday

But will Facebook shares move in mysterious ways?

The opinions expressed in this commentary are solely those of Paul R. La Monica. Other than Time Warner, the parent of CNNMoney, and Abbott Laboratories, La Monica does not own positions in any individual stocks. To top of page

NEW YORK (CNNMoney) -- Facebook is a great company. It proved that in its IPO filing. A billion dollar annual profit and $3.9 billion in cash for something that didn't even exist 10 years ago? That's impressive.

But it's not impressive enough to justify a $100 billion market value right out of the gate.

paul_lamonica_morning_buzz2.jpg

Sure, we don't yet know what Facebook will be worth once it starts trading in a few months.

The company said Wednesday that it had determined that the fair value of a Facebook share stands at $29.73, as of December 31. That would value founder and CEO Mark Zuckerberg's stake at about $16 billion.

Based on Facebook's current share count, you could come up with a rough estimate of about $60 billion for the company's market value.

But it seems highly likely that Facebook will price its offering above its most recent fair value estimate. As such, some experts have thrown out the $100 billion number as a possible market value.

I fail to see how that makes sense. Yes, Facebook is growing rapidly. It deserves a premium compared to companies like Microsoft (MSFT, Fortune 500) and Google (GOOG, Fortune 500), which are the only two publicly traded firms that Facebook listed as "significant competition."

But let's do the math. Microsoft is trading at only 11 times its net income for fiscal 2011. Google is valued at about 20 times its 2011 profits. If Facebook were to fetch a $100 billion market value, that would give it a price-to-earnings ratio of 100.

Meet the man behind the Facebook IPO

The $100 billion number is even crazier when you look at revenue. Google trades for just 5 times trailing sales. Apple (AAPL, Fortune 500) trades at only 4 times last year's sales.

Sure, Apple may not be a direct rival to Facebook. But I'd argue that it's fair to look at Apple's valuations as a benchmark since Apple is the best example of a large company that is continuing to grow as if it were just a start-up.

At $100 billion, Facebook would trade at 27 times last year's sales. That might have worked in 1999. Not now.

Yes, I realize that investors are betting on the next few years, not the past few.

"There is no way you can justify the current valuation with $3.7 billion in revenue," said Espen Robak, president of Pluris Valuation Advisors in New York. "But the promise of the company is enormous. You are buying the future."

Still, let's assume that Facebook's profits increase 65% in 2012, like they did in 2011. That's probably optimistic, since Facebook conceded in its filing that it expects growth to slow for both new users and revenue. But for the sake of argument, let's forecast net income of $1.65 billion for 2012.

A $100 billion market value would imply a P/E of about 60 on 2012 earnings forecasts. That's still pretty lofty -- especially if growth is already starting to slow.

"Think about Google. Right now it's trading at around 20 times earnings. That's a modest multiple and that's ultimately where Facebook may deserve to be," Robak said.

A P/E of 20 times my back of the envelope 2012 earnings forecast gives you a market value of $33 billion. But even if we give Facebook a fat premium of say, 40 times earnings, you still only get to a value of $66 billion.

That seems a little more reasonable. Facebook needs to play catch-up with its valuation. If it eventually is going to command a more sizeable premium than Google, it will need to prove to Wall Street that it can grow at a healthy clip for several more years.

That won't be easy.

Don't get me wrong: What Facebook has achieved in a few years is spectacular. It deserves some sort of premium. Facebook's operating margins last year were 47%. That's phenomenal. Google, by way of comparison, had operating margins of 31%.

"We can recognize that Facebook has built a successful global brand with great scale," said Lorraine Monick, managing director with Harris myCFO Investment Advisory Services, a money manager in Palo Alto, Calif.

That's true. But scale isn't enough to justify a bubble-like valuation. Yahoo (YHOO, Fortune 500) always enjoyed the benefits of great scale. It still does.

Facebook IPO: Morgan Stanley is the big winner

While Facebook is clearly in much much much better shape than Yahoo, it's not far-fetched to think that in a few years, Facebook may face some similar problems.

Facebook already has 845 million users. There isn't that much more room to grow that number. The challenge will be squeezing more profits from these users.

"If Facebook can make more money from their existing platform, they are golden," said Tim Loughran, a finance professor at University of Notre Dame. "But Facebook is much more mature than Google was in 2004. Where's the user growth going to come from?"

China is a logical answer -- but that's fraught territory.

"We do not know if we will be able to find an approach to managing content and information that will be acceptable to us and to the Chinese government," Facebook said in its filing.

Of course, none of my skepticism will make a difference when Facebook starts trading. The demand for the Facebook IPO will probably be so hot that investors will buy first and ask questions later. The $5 billion worth of stock Facebook plans to sell is a tiny amount.

"Given the small float and scarcity factor, everybody will want a piece of the action," Loughran said.

But mark my words: Valuations still matter. Eventually, Facebook will have to trade at a price that's more in line with its peers.

Best of StockTwits. Not enough on Facebook? I didn't think so.

A_F: $FB is the new $YHOO in that it has 'reach' - but $GOOG ads still monetize better for advertisers imo

JoshPritchard: $FB core product captures users' time, $GOOG core captures intent; former better for demand generation, latter demand fulfillment

Agreed. I continue to think Google's model makes mores sense because their ads should have more value.

divtastic: If there's any one stock to trade $FB it's $ZNGA

Correct. And Zynga (ZNGA), which accounted for about 12% of Facebook's sales, is up sharply Thursday. I've been surprised by how poorly Zynga has done since its IPO given how closely aligned with Facebook it is.

margbrennan: Bono's venture capital firm Elevation Partners paid $120M for a stake in facebook in '10. It is now worth ~$1.5B. $FB #beautifulday

But will Facebook shares move in mysterious ways?

The opinions expressed in this commentary are solely those of Paul R. La Monica. Other than Time Warner, the parent of CNNMoney, and Abbott Laboratories, La Monica does not own positions in any individual stocks. To top of page